jefferson parish property tax payment

The Jefferson Parish Property Tax Payment is an annual tax that is levied on all property owners in the Parish. Jefferson Parish is pleased to announce the opening of its 2022 First-Time Homebuyer Assistance Program.

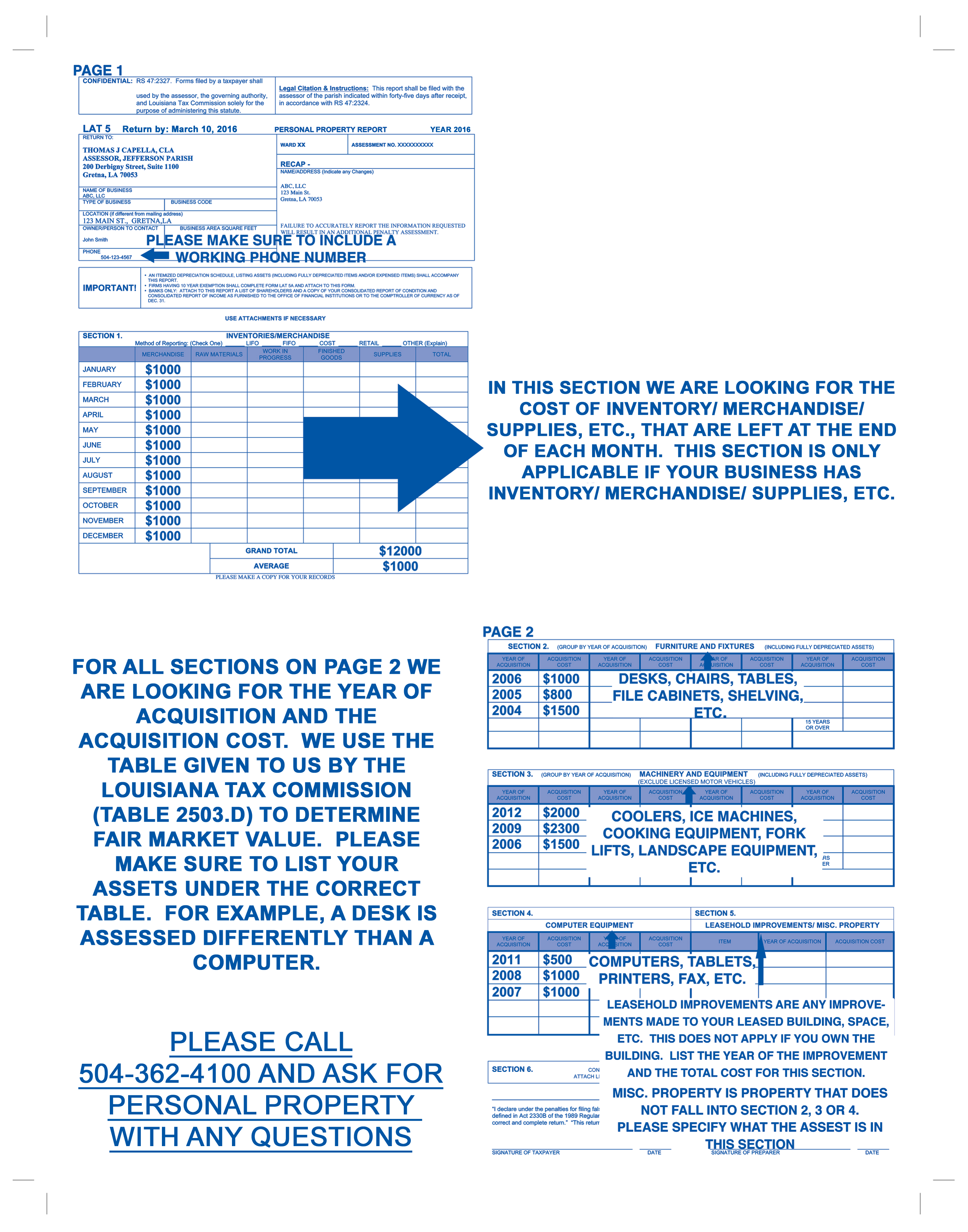

Jefferson Parish Assessor S Office Tax Estimate

CLICK MORE for information about the program and how to participate.

. The preliminary roll is subject to change. What Jefferson Parish residents need to know when paying this years property tax. The Jefferson Parish Sheriffs Office announces they will.

Can you pay property taxes online Jefferson County Alabama. Suite 1200 Gretna LA 70053. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible.

Due to Washington state law RCW 3629190 the Treasurer can not absorb the cost of online. The Treasurers Office uses Point Pay a third party vendor to process online payments. Pay Property Tax Online in the Parish of Jefferson Louisiana using this service.

Pay Property Taxes Online. Government To Citizen Using the Countys Web site Jefferson County property owners may pay property taxes online. If Jefferson Parish property tax rates have been too costly for your revenue and now you have delinquent property tax payments you can take a quick property tax loan from lenders in.

Seven months after Jefferson Parish voters approved a new property tax to fund pay increases for public school teachers the School Board on Wednesday night approved two five-year tax. Welcome to the Jefferson Parish Assessors office. Online Property Tax System Tax Year Payments are processed immediately but may not be reflected for up to 5 business days.

A convenience fee of 249 is assessed for credit card. The tax is used to fund the operations of the Parish government and its. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes.

Payments are processed immediately but may not be reflected for up to 5 business days. FAQs When are sales taxes due and which date is used to determine if a return is paid on time. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

The convenience fee amount. Every year tax bills are mailed in. A convenience fee of 249 is assessed for credit card payments.

Installment Plans for Taxpayers over 65 Years Old or Disabled Quarter Pay The Quarter-Payment Plan is available to qualified Residential Property Owners. These online services are available 24 hours a day 7 days a week and provide a secure fast and convenient way to pay traffic tickets and to file and remit Jefferson Parish sales license. Down menu on the next payment screen.

December 2 2021 1224 pm. Drop Box checks only Jefferson Parish Sheriffs Office 3300 Metairie Road 1st Floor Metairie LA. Once the preliminary roll has been approved.

Jefferson Parish Government Building 200 Derbigny St.

Jefferson Parish Clerk Of Court Forms Fill Online Printable Fillable Blank Pdffiller

Jefferson Parish Assessor S Office Resources

Jefferson Parish Assessor S Office Home

Recognizing Philanthropy Leaders In Jefferson Parish The New Orleans 100

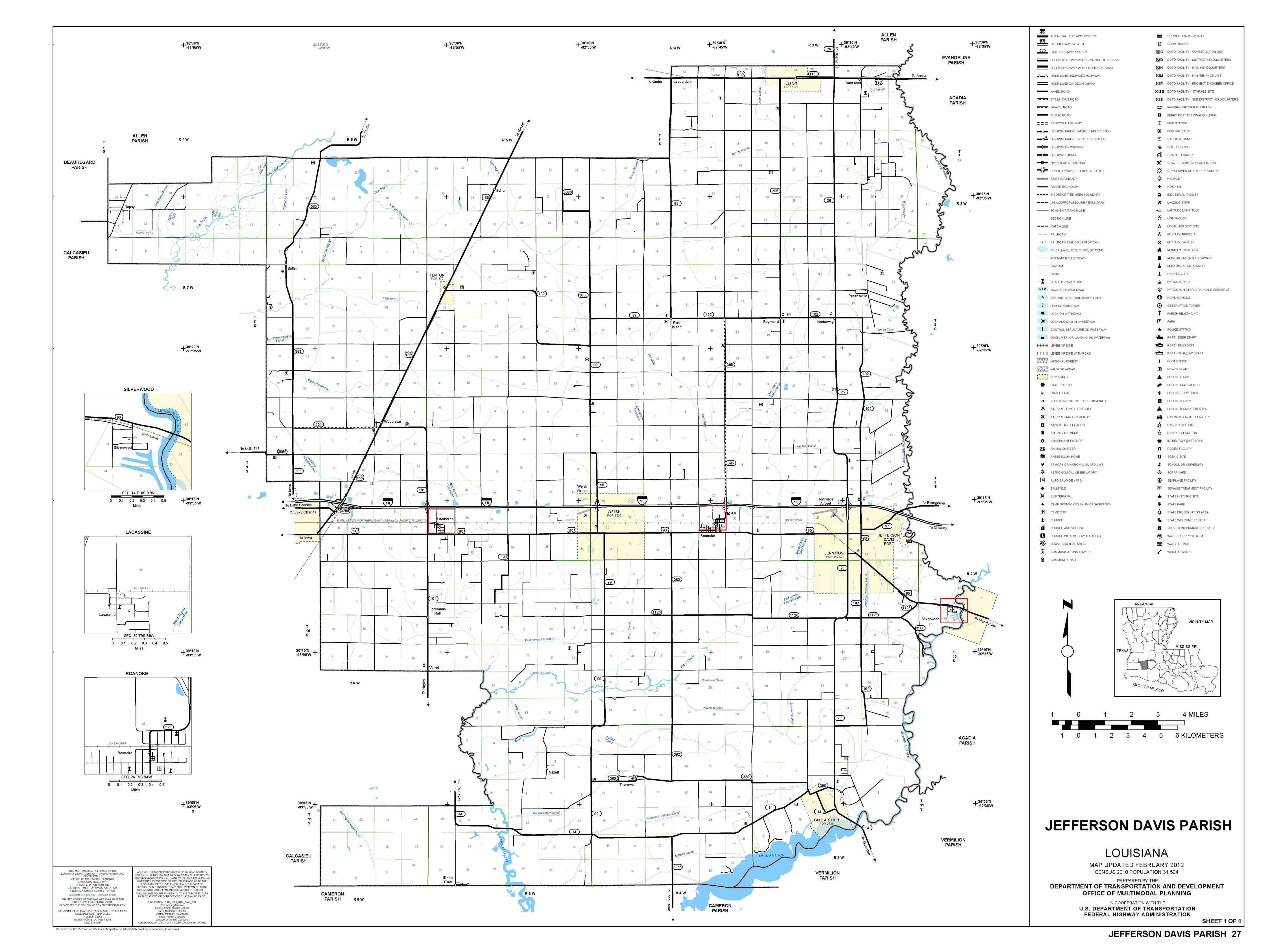

Tax Division Jefferson Davis Parish Sheriff S Office

St Tammany Parish Homestead Exemption Form Fill Out Sign Online Dochub

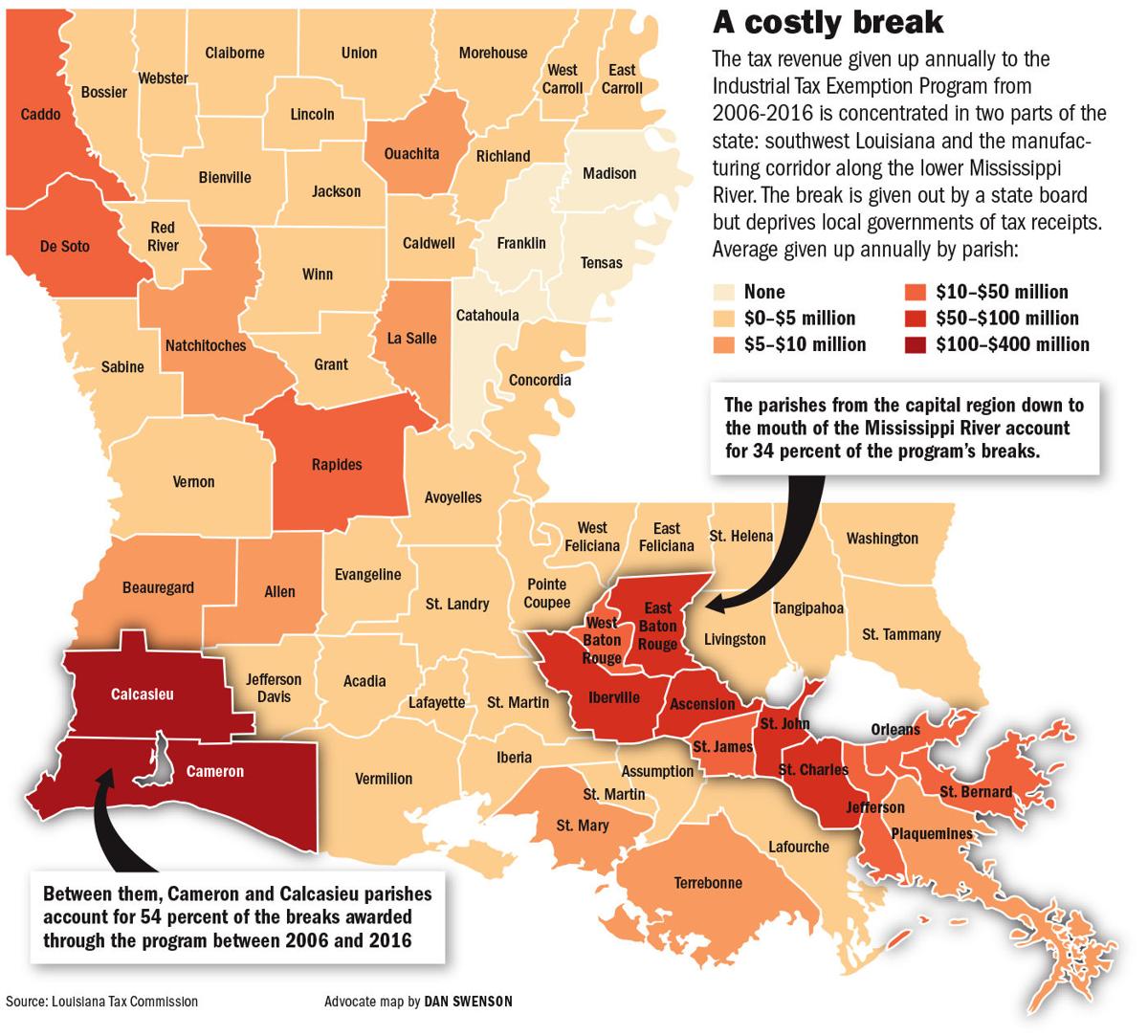

Why Louisiana Isn T The Petrochemical Silicon Valley Of The United States Via Nola Vie

Jefferson Parish Code Form Fill Out And Sign Printable Pdf Template Signnow

Jefferson Parish 20 Raise For Deputies Could Mean More Taxes For Residents With Proposed Millage Wwltv Com

Poll Taxes In The United States Wikipedia

Payments Jefferson Parish Sheriff La Official Website

Payments Jefferson Parish Sheriff La Official Website

Breaking Down 1 25 Billion In Orleans Parish Tax Revenue

Jefferson Parish Louisiana Home

Tax Division Jefferson Davis Parish Sheriff S Office

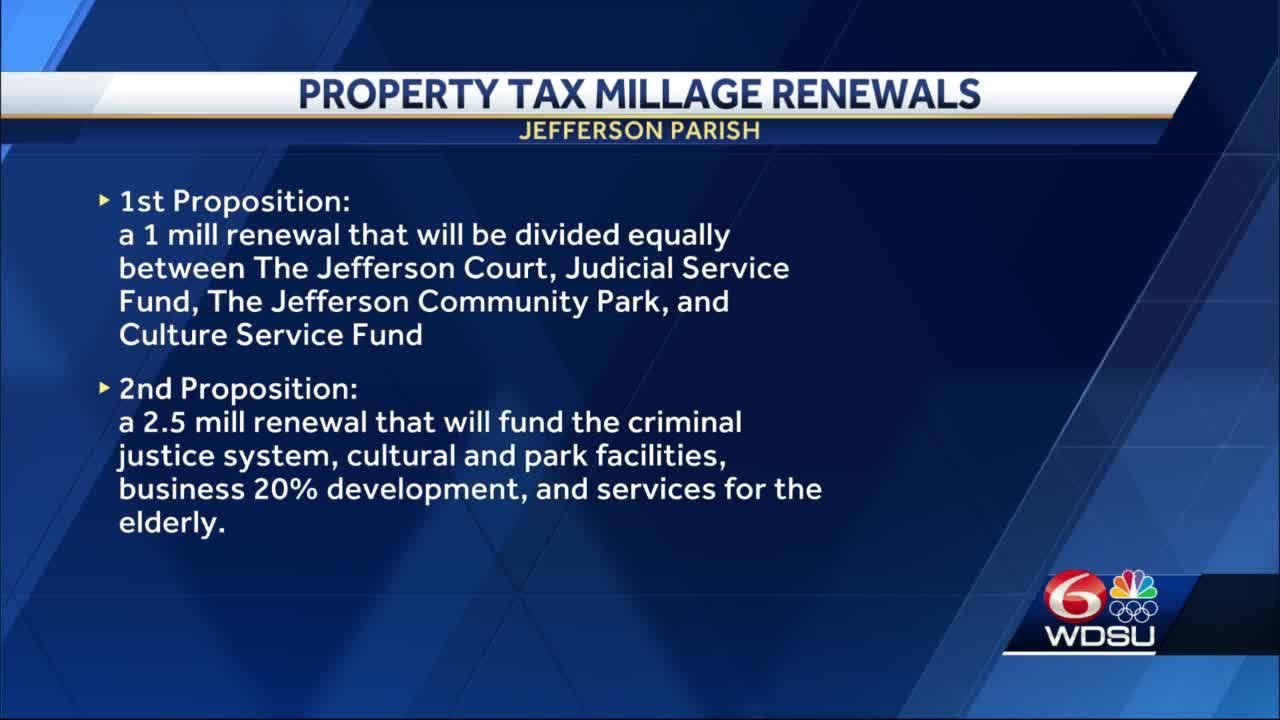

Jefferson Parish Residents Will See Several Millages On Ballot

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com